Home / News & Insights / April 23, 2021 / ...

How to Prepare for Successful Debt Recovery Phone Calls

Begin by researching all the relevant information so you’re armed with the facts. Once the debtor picks up, listen carefully to what they have to say, but be sure to stay calm and stick to the facts. Maintain an open yet authoritative tone and you will be well on the way to achieving a successful outcome.

Do your research

Before you make the first debt recovery call, strengthen your position by ensuring all the relevant details are at your disposal. Create a profile of the debtor including their business and typical dispute pattern. Identifying a habitual debtor will strengthen your resolve against pleas for leniency. Note the debtor’s location, time zone, hours of business, and who you should speak to about the balance. This may depend on whether the file is consumer or commercial.

Calculate the exact account balance. From the off, your credibility depends on knowing the right amount due and the date of each invoice. Any mistakes or errors weaken your position, allowing the debtor to promote confusion or challenge your authority. Finally, set a clear objective for your call and know exactly what you want to resolve before you pick up the phone.

Stick to the facts

There are some golden rules when it comes to making sure your debt recovery call is successful. Once you have completed your research and identified the primary decision maker, you are ready to pick up the phone. Remain calm and professional and ask for payment clearly. Your demand must be unambiguous, or the debtor may choose to ignore the purpose of the call.

Undoubtedly, the debtor will respond with their side of the story. Stay focused and acknowledge you have heard them before reiterating the facts based on the evidence you have gathered. Repeat the full balance and the specified date for payment.

After asking for payment, remain silent for five seconds. This is a powerful negotiating tool. The debtor’s response will either provide a date for payment or reasons why they can’t pay, which you can utilize in your negotiations. Listen carefully to what they say and pay attention to what they omit or to any inconsistencies that may strengthen your hand.

A successful outcome depends on finding the obstacle preventing the debtor from fulfilling their obligation. Bear in mind, however, that this may not be the problem that the debtor has themselves identified. If it were, the situation would not have escalated this far.

No matter how tempting, avoid making the first offer. Help the debtor identify a solution but retain the upper hand by inducing them to make the opening concession. If the matter is not resolved on the first call set a clear action plan with definite deadlines and make it clear that inaction is not an option from now on. Your goal throughout is to create and maintain urgency so a clear and immoveable deadline is essential.

Close the call by restating the outstanding balance, due date, and how to remit payment, reminding them of the negative consequences of continued non-payment.

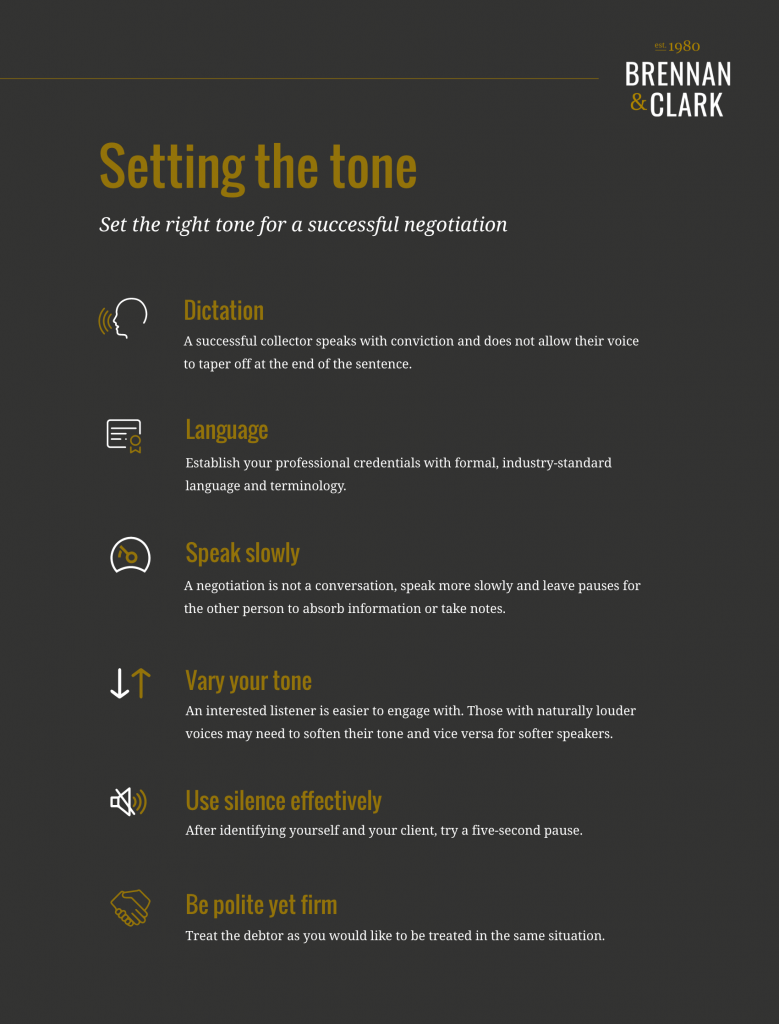

Set the tone

Throughout the call, you should communicate clearly, calmly, and professionally. If you find yourself becoming over friendly, or at the other end of the spectrum, appearing overly frustrated or hostile, you will have lost your authority.

Getting the balance right can be tricky but setting the tone for your debt recovery call is vital. Start by speaking clearly and with conviction. Don’t let filler words such as ‘ah, umm’ and ‘like’ become part of your repertoire. Use formal, industry-standard language and explain any terminology with which the debtor is genuinely unfamiliar.

Remember, a negotiation is not a conversation so don’t speak too rapidly. Leave pauses for the other person to absorb what you are saying or to note things down. Silence is a valuable tool in negotiation so after asking a question, resist the urge to elaborate. Let the debtor react first.

Finally, bear in mind that an assertive and confident approach will achieve more than over familiarity or an aggressive tone. Ensure the debtor knows there is no further time for delay or dispute by speaking with credibility, conviction, and urgency.

Remain open and professional at all times and you’ll be far more likely to negotiate a successful resolution.

Download our free guide to Mastering the Art of Collections for further advice on effective negotiation techniques, or give us a call and speak to one of our experts today.